Carbon, prepare to be crushed. Today Fort Worth- and San Francisco-based TPG Rise Climate announced it has raised $5.4 billion in subscriptions to its inaugural fund. The goal: invest in entrepreneurs and businesses building climate solutions around the world.

TPG Rise Climate ultimately plans to raise $7 billion in total capital commitments by end of this year from some of the world’s largest institutional investors and more than 20 leading companies.

“A time of peril and possibility”

“It’s a time of both peril and possibility,” said Jim Coulter, managing partner of TPG Rise Climate, in a statement. “Climate change is a societal risk but also a generational investment opportunity.”

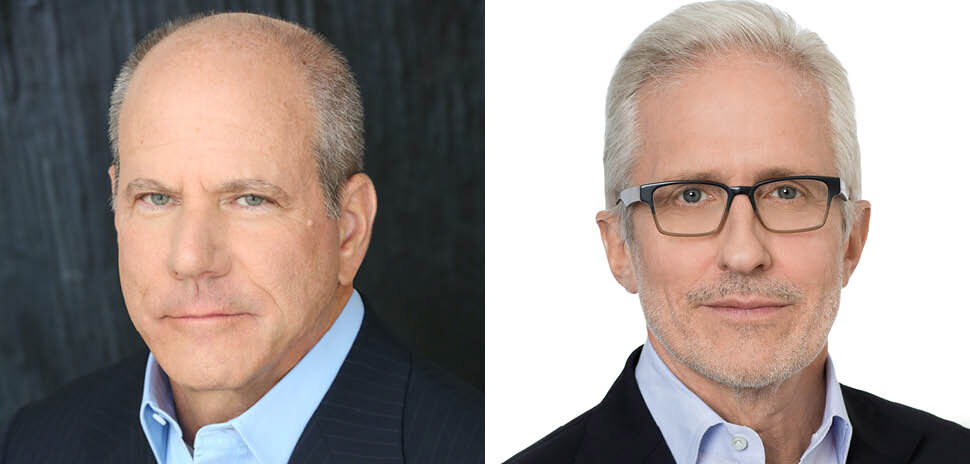

Jim Coulter, Executive Chairman and Founding Partner, TPG

Coulter, who is executive chairman and a founding partner of TPG, believes capital can combat one of the greatest challenges facing the earth.

“Leveraging our deep experience in impact investing, we believe TPG Rise Climate can play a positive role in catalyzing capital to combat climate change,” he said. “The partnership of leading investment institutions and major corporations funding TPG Rise Climate signals a growing business community commitment to engaging in this existential issue.”

From clean energy to natural solutions

TPG Rise Climate will use the funding to focus on five key solutions: clean energy, enabling solutions, decarbonized transport, greening industrials, and agriculture and natural solutions.

The effort is a big step in the growth of TPG’s global impact investing platform. TPG’s Rise Fund was founded five years ago in partnership with U2’s Bono and Jeff Skoll to invest in companies that drive measurable social and environmental impact.

TPG Rise Climate was launched in early 2021, with former U.S. Treasury Secretary Hank Paulson serving as executive chairman. The fund takes a growth equity approach as it collaborates with companies, entrepreneurs, and scientists who’ve pioneered climate solutions in the last 10 years.

With today’s announcement, TPG now manages over $11 billion of assets across TPG Rise, staking even stronger claim to being the world’s largest private markets impact investing platform.

20+ founding companies and members

The Rise Climate Coalition is comprised of more than 20 founding companies and members including 3M, ADM, Allianz, Allstate, Alphabet, Apple, AXA, Bank of America, Boeing, Dow, Exor, FedEx, GE, General Motors, Honeywell, John Deere, former presidential candidate Mike Bloomberg, NIKE, Sumitomo Mitsui Banking Corporation, Smithfield Foods, and TD Bank Group.

The coalition includes companies that have infused sustainability and climate action into their businesses. Most of them have made significant public commitments to improve their climate footprints.

Institutional investors

This first close by TPG Rise Climate received subscriptions from Allstate, AXA, The Hartford, Ontario Teachers’ Pension Plan Board, Public Investment Fund, Public Sector Pension Investment Board, School Employees Retirement System of Ohio, Silk Road Fund, State of Michigan Retirement System, Universities Superannuation Scheme, and the Washington State Investment Board.

“TPG Rise Climate includes a unique group of global institutional and corporate investors that are united by capital, innovation, and accountability,” Hank Paulson said in the statement. “Together, we can catalyze climate-focused capital to accelerate and scale climate solutions of tomorrow.”

Leveraging Y Analytics

As part of the effort, TPG will conduct rigorous impact assessment through Y Analytics, a public benefit LLC dedicated to understanding, valuing, and managing and investment’s social and environmental impact.

TPG Rise Climate will use Y Analytics methodologies like Carbon Yield—a decision tool powered by scientific, health, economic, and social science research— to estimate how much carbon dioxide-equivalent emissions are avoided by each dollar invested.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

![Chakri Gottemukkala, co-founder and CEO, o9 Solutions, Inc. [Photo: Business Wire]](http://s24806.pcdn.co/wp-content/uploads/2022/01/Chakri-Gottemukkala-970x464.jpg)